Budget usually means an estimation of revenue and expenses over a specified future period of time. It helps to create financial stability i.e. leading to stronger financial footing for day to day and long-term plans both.India’s Budget 2022 was presented in the Parliament on 1 February 2022. It was focused on accelerated growth of economy after the impact caused by second and third wave of this pandemic. Like every budget, this was also more focused on Incomes and expenses.

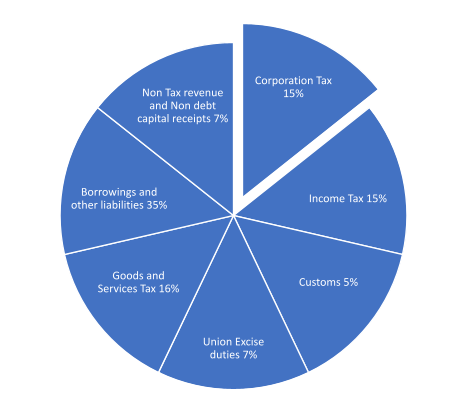

The source of government’s income can be broadly classified along with its percentage of contribution as follows:

Source: Ministry of Finance.

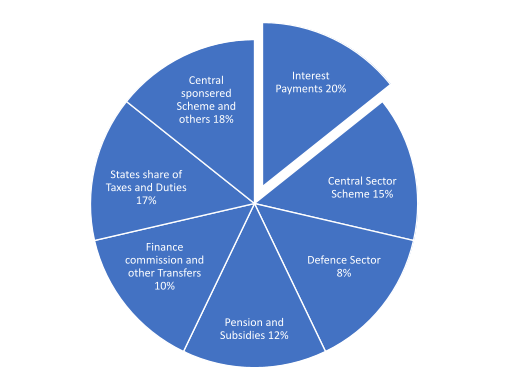

As far as the expenses of India is concerned, it can be classified along with its contribution as follows:

Source: Ministry of Finance.

In this piece of writing, we will discuss the impact of this iconic budget on companies, investors, taxpayers and the common man. No doubt, Budget 2022 comprised steps and plans that will boost economy in the near future but there are certain sections of population which are not much happier.

- Investors Community

- Virtual Digital Assets have been defined to include Cryptocurrency, Non-Fungible Tokens (NFTs) and others to be notified by Central Government.

- Bad news for crypto investors is that income from transfer of any Virtual Digital Assets to be taxed at 30%, with the effect from FY 22-23.

- No deduction of any expenditure except cost of acquisition is allowed.

- Set-off of losses incurred on Virtual digital assets is not permitted against any other income.

- Carry forward of such losses to subsequent years is not permitted as well.

- Another harsh point is 1% TDS on purchase of Virtual digital assets from 1st July 2022, subject to some exceptions.

- In the budget 2022 there were no remarkable good news for the Investors community but announcement of Digital currency by RBI i.e Central Bank Digital Currency (CBDC) to be introduced in FY 22-23, grasped considerable attention.

- Businesses & Companies

- Indian Government is promoting Startups and Domestic Manufacturing Companies to a great extent.

- The period of incorporation of startups eligible for Tax Holidays (Deduction of 100% profits) extended for one more year to 31st March 2023.

- The period of commencement of manufacturing or production by eligible new manufacturing domestic companies has been extended by one more year to 31st March 2024 and will continue to enjoy the beneficial rate of 15%.

- Customs duty rates has been increased on some goods to encourage domestic manufacturing, whereas decreased for the inputs required for these domestic manufacturing units.

- Various moves have been taken to support local manufacturing of wrist wearables, smart watches, hearables, smart electric meters and their components.

- One bad news for these companies is that there will be a 10% TDS on the benefits and perquisites over INR 20,000 which will be received in course of business or profession.

- Taxpayers

- Taxpayers will now be given 2 years from the relevant assessment year to update tax return and pay additional taxes if any, regardless of whether a return of income was filed previously or not.

- If a taxpayer misses the deadline for filing belated or revised returns can get extension as well.

- Additional income tax payable of 25% of ‘Aggregate Tax and Interest’, if updated return is filed after the expiry of time limit to file the belated/revised return but within 1 year from the end of relevant AY and 50% thereafter. 50% additional tax is likely to worry some taxpayers.

- One more bad news is that No loss can now be set-off against undisclosed income discovered by searches or surveys.

- On the other hand, good news for COVID-19 victim, Payment received from employer or any other source for COVID-19 treatment has been made exempt. Also, any sum of money received by a member of the family of the deceased employee from the employer (without any limit) on account of COVID-19 related illness within 12 months from the date of death has been made exempt subject to certain conditions as may be notified.

- Any sum of money received by a member of the family of deceased individual from other persons up to INR 10,00,000 on account of COVID-19 illness within 12 months from the date of death has been made exempt subject to certain conditions as may be notified.

- Consumers

- Import duty on cut and polished diamonds and gemstones has been reduced from 7.5% to 5%, whereas duty on sawn diamonds has been brought to NIL. This is good news for buyers of these items.

- On the other hand, custom duty on Imitation jewelry has been raised to 20% or INR 400/KG, whichever is higher.

- Government has made many policies for Infrastructure Development, Employment creation, Ease of doing business and Digital push to Financial Services which will help in expansion of GDP of India.

- Union Budget 2022 also consist of policies for expansion of Industries be it Automotive Industries(EV), Real Estate, Technology, Telecom, Oil and Gas, Life sciences and health care and others. Industrial development helps in rapid growth of National and Per capita Income.

Overall, Budget 2022 demonstrates the government’s intent to touch every aspect of the economy and to leave no stone unturned be it digital economy push, infrastructure boost or energy sector. While some relief in terms of personal taxation would have added more cheers to general population. The Union Budget 2022 comprising of all the growth-oriented policies which will help in achieving the budgeted growth i.e. 9.2% expansion in GDP in FY 22 & projected GDP growth of 8 to 8.5% for FY-23. Budget 2022 is a step ahead in line with government’s efforts over the past few years to fulfill the vision of making India a $5 Trillion economy. India having vision of becoming a global power in near future, this Budget 2022 will serve as guiding light on India’s pathway to prosperity and international dominance. This budget also needs an applause for the fact that the economy is gradually healing from the wounds of the pandemic. Now there will be various stakeholder discussions in upcoming weeks, and one will have to see what transpires into the Finance Act, 2022.

For details, please refer the attached pdf:

Disclaimer

This blog/article is merely for knowledge purposes only and is not a substitute for legal and other professional advice. All the references or content are for educational purposes/academic discussions only and do not constitute a legal advice. We accept no responsibility for any errors it may contain or for any loss, howsoever caused or sustained, by the person who relies on it.