The 49th GST Council Meeting was held on the 18th of February, 2023 and the following were the recommendations: –

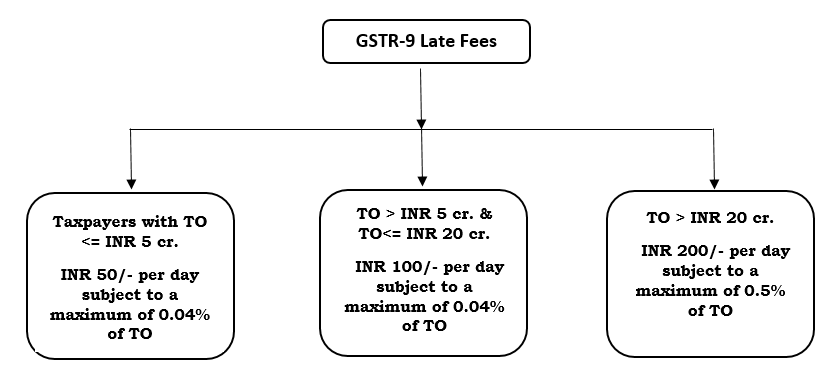

- Turnover (TO) based reduction in late fees for late filing of Annual Return (GSTR-9) from FY 2022-23 onwards.

- Time limit for filing revocation of cancellation of registration extended to 90 days from the previous 30 days limit. The commissioner has the power to further extend this limit to 180 days.

- GSTC also recommended rolling out amnesty for taxpayers whose registration has been canceled because of non-filing of returns but the time limit to revoke such cancellation expired. A one-time opportunity will be given to revoking their cancellation of registration.

- One-time amnesty scheme for past cases wherein best judgment assessment order has been issued. Previously such an order was deemed to be withdrawn if the relevant returns were filed within a period of 30 days of service of said order. Now GST council has recommended extending this time limit to 60 days and further extendable by 60 days.

- GSTC has also recommended revising the tax rate on certain products i.e. pencil sharpeners (12 % instead of 18%) and Rab i.e. liquid jaggery (5% instead of 18%)

- Scope of exemption extended to fees charged for entrance examinations. Now it also includes authorities and boards established by central & state governments, including the national testing agency, for conducting entrance examinations in educational institutions i.e. GST would not be levied on fees charged for examinations conducted by these authorities as mentioned above.

- Report of the Group of Ministers (GOM) was presented for the establishment of the GST Appellate Tribunal. It has been recommended that there will be only one GST Appellate Tribunal, having its benches across all the states.

For more details, please refer the link below: – https://www.pib.gov.in/PressReleasePage.aspx?PRID=1900376

To download the pdf file of the above post, please click on the download button below.

About Our GST & Indirect Tax Services

DPNC Global LLP is a full service consulting firm providing multi-disciplinary services to clients ranging from MNCs, Indian Corporates from across industries to Family Offices and UHNIs, both in and outside India.

Our GST & Indirect Tax Services team focuses on resolving practical issues faced by taxpayers and businesses while ensuring due compliance with complex legislation. Our services extend from timely and systematic support for GST compliances to advisory on a wide range of contemporary indirect tax issues and GST litigation support.

Our team of GST Consultants possesses in depth experience across diverse sectors and offer tailored solutions for tax optimization while ensuring due compliance with this complex and dynamic legal transaction regime law. To know more about our services, visit https://dpncglobal.com/

DISCLAIMER:

The information contained herein is prepared based on the information available on the public domain. While the information is believed to be accurate to the best of our knowledge, we do not make any representations or warranties, express or implied, as to the accuracy or completeness of this information. Reader should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.