Foreign Trade Policy (FTP) 2015-20 which was to end on 31.03.2020 was extended due to the COVID pandemic and volatile geopolitical scenario till 31.03.2023. With the start of the new Financial Year 2023-24, the government launched the Foreign Trade Policy 2023.

FTP 2023 has 4 pillars i.e. Incentive to Remission, Export promotion through collaboration, Ease of doing business and Emerging Areas.

KEY HIGHLIGHTS

- Ease of Doing Business, Reduction in Transaction Cost and e-Initiatives

- Automatic approval of various permissions under Foreign Trade Policy based on process simplification and technology implementation.

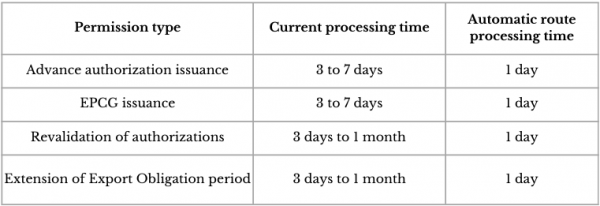

- Reduction in processing time and immediate approval of applications under automatic route for exporters

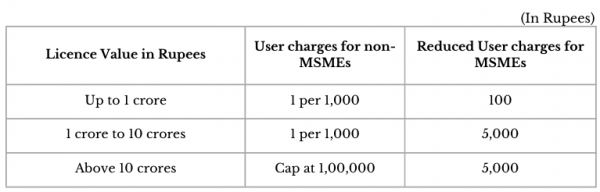

- Reduction in user charges for MSMEs under AA and EPCG

- Application fee being reduced for Advance Authorization and EPCG Schemes

- Fee structure as shown below-

- E-Certificate of Origin

- Revamp of the e-Certificate of Origin platform proposed- to provide for self-certification of CoOs as well as automatic approval of CoOs, where feasible.

- Initiatives for the electronic exchange of CoO data with partner countries envisaged.

- Paperless filing of Export Obligation Discharge Applications

- All authorisation redemption applications to be paperless – This is in addition to the application process for issuance being already paperless. With this, the entire lifecycle of the authorization shall become paperless.

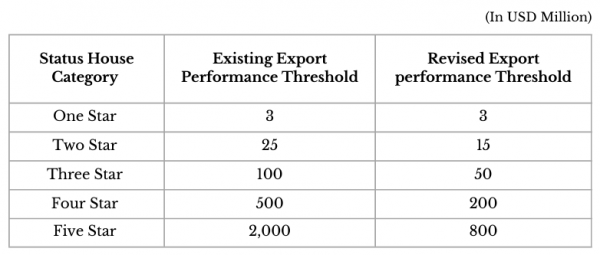

- Status Holder Export Thresholds Rationalised of India shall be the destination of goods.

- Export performance threshold for Recognition of Exporters as Status Holders rationalized. Enabling more exporters to achieve higher status and reducing transaction costs for exports.

- Merchanting Trade Reform

- To boost merchanting activities from India – Merchanting trade involving the shipment of goods from one foreign country to another foreign country without touching Indian ports, involving an Indian intermediary is allowed subject to compliance with RBI guidelines, except for goods/items in the CITES and SCOMET list.

- Rupee Payment to be accepted under FTP Schemes

- Effective step towards internationalisation of the Rupee

- FTP benefits extended for rupee realisations through special Vostro accounts setup as per RBI circular issued on 11 July 2022

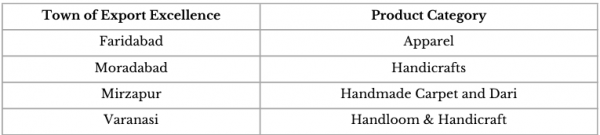

- Towns of Export Excellence

-

- Four new towns of export excellence declared

- Recognition of these industrial clusters is granted to maximize their potential and enable them to move up the value chain and tap new markets.

-

- States and Districts as Partners in Export Promotion

- Districts as Export Hubs aim to boost India’s foreign trade by decentralizing export promotion & bringing a greater level of awareness and commitment regarding exports at the district level.

- Identification of products/services in all the districts.

- Create institutional mechanisms at the State and District level to strategize exports (State Export Promotion Committee & District Export Promotion Committee).

- Preparation of District Export Action Plans (DEAPs) outlining the action plan to promote identified products and services.

- Capacity Building at the District level & Districts to focus on the development of logistics, testing facilities, connectivity for exports and other export-oriented ecosystems.

- E-Commerce Exports & Dak Niryat Facilitation

- All FTP benefits to be extended to e-Commerce exports and streamline facilitation – Guidelines being formulated in consultation with other ministries to facilitate further exports under

- e-Commerce.

- Value limit for exports through courier is increased to INR 10,00,000 per consignment.

- Steps to Boost Manufacturing

- The Prime Minister Mega Integrated Textile Region and Apparel Parks (PM-MITRA) scheme has been added as an additional scheme eligible to claim benefits under the CSP (Common Service Provider) Scheme of Export Promotion Capital Goods Scheme (EPCG).

- The dairy sector to be exempted from maintaining Average Export Obligation – to support the dairy sector to upgrade the technology

- Battery Electric Vehicles (BEV) of all types, Vertical Farming equipment, Wastewater Treatment and Recycling, Rainwater harvesting system and Rainwater Filters, and Green Hydrogen are added to Green Technology products – will now be eligible for reduced Export Obligation requirement under EPCG Scheme

- Benefits of Self-Ratification Scheme for fixation of Input-Output Norms extended to 2 stars and above status holders in addition to Authorised Economic Operators at present

- Fruits and Vegetable exporters are being included for double weightage for counting export performance under eligibility criteria for Status House certification. This is in addition to the existing MSME sector which also gets double weightage.

- Amnesty Scheme for Default in Export Obligations:

- In the interest of trade and industry and to motivate the exporters, relief will be provided to exporters who are unable to fulfil their EO against the EPCG and Advance Authorisations. An amnesty scheme for one-time settlement of default in export obligation by Advance Authorisation and EPCG authorisation holders is being introduced

To download the pdf file of the above post, please click on the download button below.

About Our GST & Indirect Tax Services

DPNC Global LLP is a full service consulting firm providing multi-disciplinary services to clients ranging from MNCs, Indian Corporates from across industries to Family Offices and UHNIs, both in and outside India.

Our GST & Indirect Tax Services team focuses on resolving practical issues faced by taxpayers and businesses while ensuring due compliance with complex legislation. Our services extend from timely and systematic support for GST compliances to advisory on a wide range of contemporary indirect tax issues and GST litigation support.

Our team of GST Consultants possesses in depth experience across diverse sectors and offer tailored solutions for tax optimization while ensuring due compliance with this complex and dynamic legal transaction regime law. To know more about our services, visit https://dpncglobal.com/

DISCLAIMER:

The information contained herein is prepared based on the information available on the public domains. While the information is believed to be accurate to the best of our knowledge, we do not make any representations or warranties, express or implied, as to the accuracy or completeness of this information. Reader should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.