The Direct Taxes Committee of PHDCCI organized a Virtual Conference on “TDS” on Tuesday, 29th August, 2023.

The eminent speakers adeptly discussed relevant provisions and intricacies of the topic in a clear practical comprehensive manner sharing their extensive expertise and experience.

Topics covered were:-

- Theme Address

- TDS provisions on Payment to contractors (S. 194C), Fees for professional or technical service (S. 194J) and Commission or brokerage (S. 194H)

- TDS provisions on payment of certain sums by e-commerce operator to e-commerce participant (S. 194-O) and TDS on payment of certain sum for purchase of goods (S. 194Q)

- TDS Provisions related to non-residents (S. 195)

- TDS provisions on benefit or perquisite in respect of business or profession (S. 194R) and on payment of certain amounts in cash (S.194N)

- TDS provisions related to renting of assets or transfer of immovable property (S.194I, S.194IA, S.194IB, S.194IC)

- Consequences for assessee in default (S. 201)

DPNC Global LLP was one of the Knowledge Partners for the said Webinar.

The webinar was well attended by around 900 participants on Zoom and YouTube.

To watch the webinar, below is the YouTube Link:-

https://youtu.be/0RfI091_rKc?feature=shared

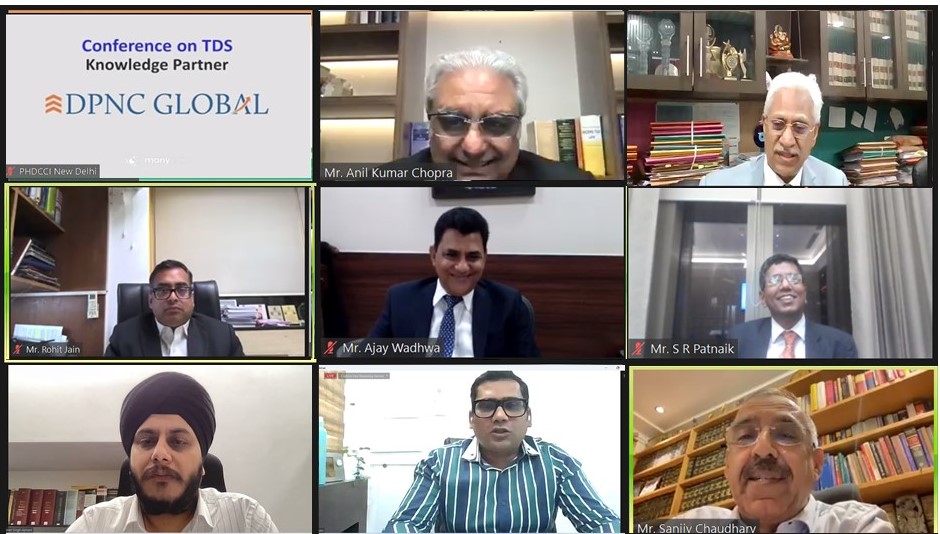

Snapshot of the Webinar